Without giving details, he also says that the company is looking to the metaverse. “You cannot ignore a market of US$ 3, US$ 4 trillion”, remembers Valente. It is a pioneer and was able to see an opportunity to work within digital assets”, extols the director.įor him, the company’s focus on digital assets is to work in a pioneering way and contribute to the environment within the company’s socio-environmental governance (ESG) core.

“Ambipar has great dynamics in the market, with all its size. Proof of this is that last week the company announced the purchase of the Canadian company Ridgeline, the 13th recent acquisition in North America alone. After all, it is not news that the company based in Nova Odessa, in the interior of São Paulo, is restless.Īmbipar brings in its business the search for innovation and constant growth. Given the success of the initiative, Ambipar is already looking at the next steps in the digital assets sector.

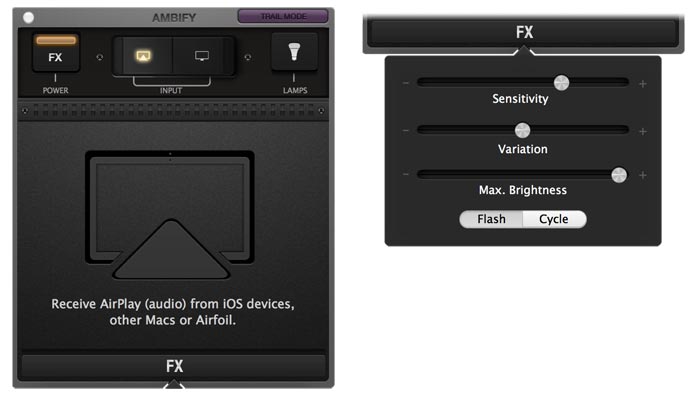

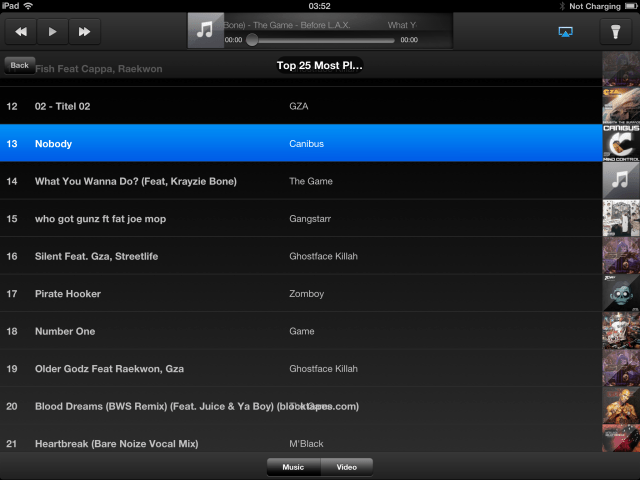

“We are very happy with this announcement by Verra, because it means that we are doing it right and that we are already anticipating some problems that may exist in the market”, stated João Valente. The transparency and integration of the Ambipar initiative received praise from Verra, attesting that the platform meets 100% of the requirements. The credits purchased are certified by the VCS, Verra’s international certification standard – which validates more than 70% of the carbon credits in the global voluntary market.Įach VCS-certified credit has a tracked “serial number”, which is withdrawn from circulation once retired. To ensure security and transparency in user transactions, the application uses blockchain technology. The focus was to avoid any possibility of greenwashing – a term that refers to the use of environmental projects more as a marketing tool than in practice. One of Ambipar’s concerns regarding the launch of the platform was the issue of transparency regarding carbon credits.įor this reason, Valente reveals that Ambify spent some time on the drawing board until all the gaps were filled. “Several relevant companies within the market here and abroad are also developing these APIs (programming interface) to be able to plug in”, he revealed.Īmbipar’s director of digital assets, João Valente, celebrated the engagement around Ambify. Valente adds that other sectors are already in direct contact with Ambify.“We already have several sectors: transport, food, finance”, he lists. The bank used Ambify’s services to allow customers to calculate and offset carbon emissions from within the app itself. CNPJs of large companies have also sought more information about the carbon credit market. The Ambipar director celebrates the interest not only of individuals. We are investing a lot in culture, information, in knowing what Ambify is and its possibilities”, explains Valente. “A pioneering project to give individuals the popularization of carbon credit requires overcoming some challenges. The other challenge is to break new ground in tokenization, which, according to him, is still incipient in Brazil. The first, the carbon credit market, which is little explored culturally and educationally. The director of digital assets at Ambipar, João Valente, points out that the initiative was born with two major challenges. And the company’s balance regarding engagement around the project is positive. Ambipar (AMBP3) launched the Ambify platform almost eight months ago, an application that enables individuals to reduce and offset carbon emissions.

0 kommentar(er)

0 kommentar(er)